what months are property taxes due

If the tax bills are mailed late after May 1 the. January 1 2021 - December 31 2021.

Property Taxes Historical Data Mn House Research

However if you are a senior citizen you may be eligible for a Property Tax.

. What months are property taxes due. What Month Are Property Taxes Due In Ny. Extra Time for Quarterly Payers.

Last day to file for tax-exempt status with the assessor. Property values are determined for the year and the exemption qualifications are set. Single taxpayers and married.

Business property statements are due. Your 2011 assessment was based on the value of your. 10 hours agoFor couples who file jointly for tax year 2023 the standard deduction increases to 27700 up 1800 from tax year 2022 the IRS announced.

Alphabetical Summary of Due Dates by Tax Type. What months are real estate taxes due. The rate is multiplied against the assessed value of the property minus exemptions to determine the amount of taxes due.

In New York property taxes are due on the first of July. Because the property burned down after Taxable Status Date your 2011 assessment was based on your property with your home intact. A tax lien is placed on all property to ensure pay each tax bill is paid.

In most counties property taxes are paid in two installments usually June 1 and September 1. If you purchase in September your due date will be. If your payment due date falls on a weekend or a federal holiday your payment is due the next business day.

Payment Dates for Weekly Payers. Escrow Taxes Collected When Taxes Are Due. Assessment date for both real and.

The first installment is due September 1 of the property tax year. In most counties property taxes are paid in two installments usually June 1 and September 1. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on.

What is the deadline for property taxes in Florida. For closings that occur when the property taxes are due typically between October 1st and February 1st the aforementioned information is. If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due.

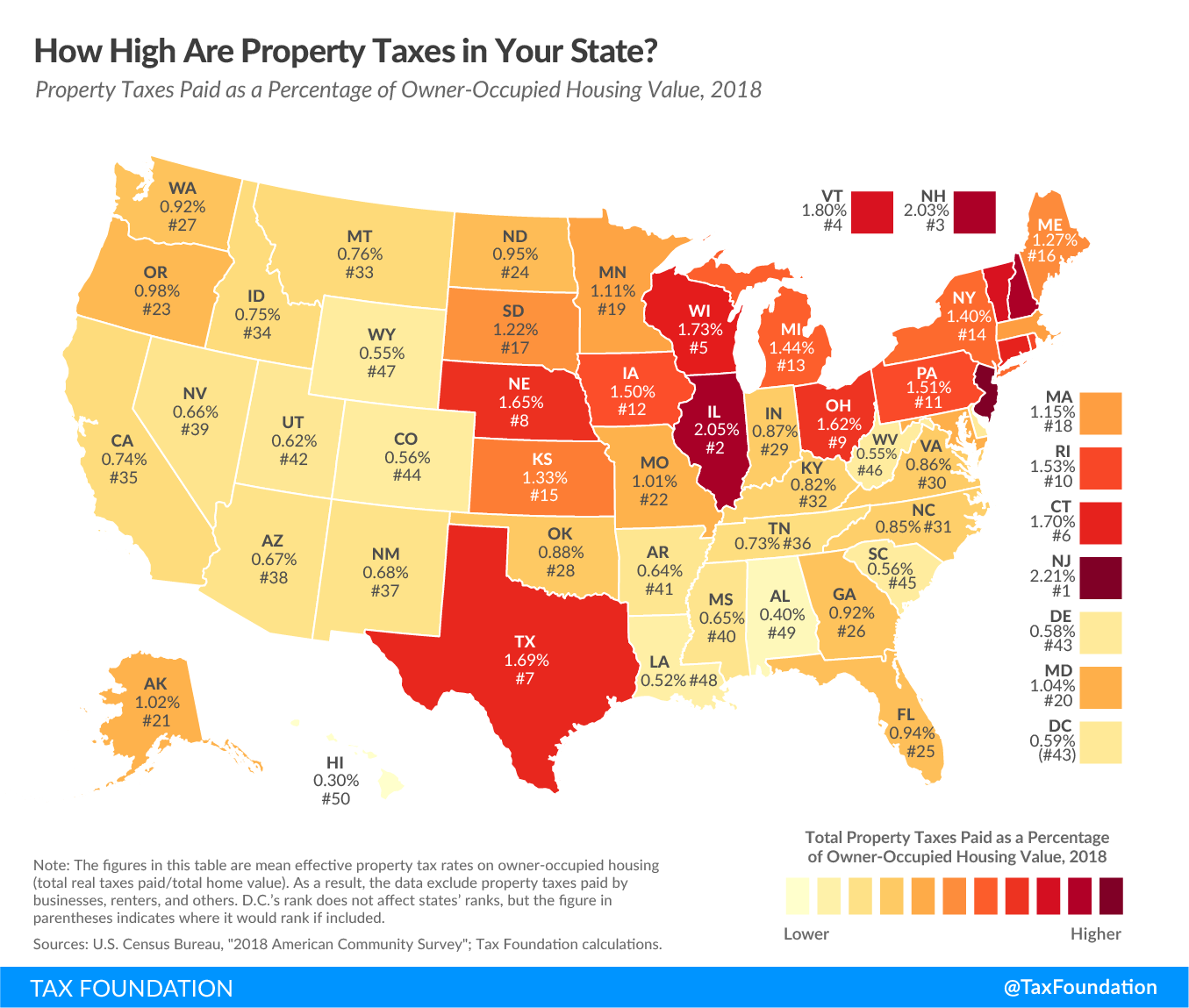

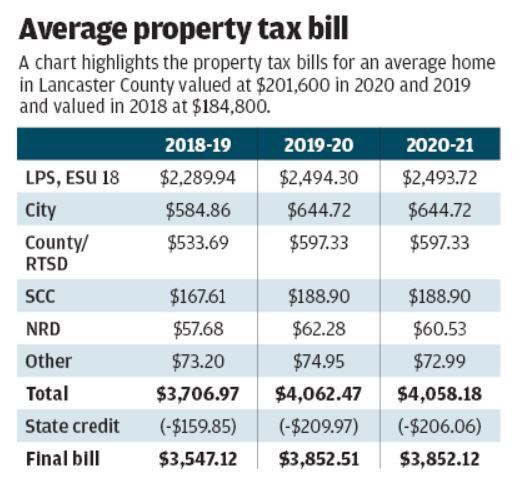

PROPERTY TAX DUE DATES. Second installment of taxes for property assessed on the secured roll must be paid by 5 pm. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

In Person - The Tax Collectors. Tax amount varies by county. A 25 percent discount is allowed for first-half property.

189 of home value. In most counties property taxes are paid in two installments usually June 1 and September 1. Form PW -1 is due with payment by the 15th day of the.

Assessment date for both real and personal property. The second installment is due March 1 of the next calendar year. Chronological Listing of Filing Deadlines.

HOW TO PAY PROPERTY TAXES. If you purchase unsecured property in August the due date becomes September 30 delinquency occurs on November 1st. In most counties property taxes are paid in two installments usually June 1 and September 1If the tax bills are mailed late after May 1 the.

What months are real estate taxes due. What months are real estate taxes due. Half of the First Installment is due by June 3 2021The remaining half of the First Installment is due by August 3 2021.

Or close of business whichever is later to. The first installment of secured property tax is due on November 1st and becomes delinquent after December 10th. How much is property tax in Long Island.

Annually to report estimated withholding tax paid and to pay any additional withholding tax due on behalf of its nonresident shareholders. If the tax bills are mailed late after May 1 the.

Wisconsin Policy Forum Investigating Residential Property Taxes

Iowa S High Property Taxes Iowans For Tax Relief

First Installment Of Fy 2022 23 Real Property Taxes Due Next Month Kauai Now

How Are Property Taxes Handled At A Closing In Florida

Property Taxes Due July 10 Penalties To Be Added On July 11 Wslm Radio

Property Taxes What Are They How To Calculate Bankrate

Paying Your Entire Property Tax Bill In December Can Mean Tax Savings That S Rich Short Cleveland Com

What The Gov Cook County Property Taxpayers Have Two Extra Months To Pay Their Bills Better Government Association

Property Taxes By State 2017 Eye On Housing

Deadline Extended To Pay Real Estate Taxes For Second Half Of 2020 Prince William Living

Press Release Pilot Program To Prevent Property Tax Foreclosure Kicked Off By State Treasurer S Homeowners Task Force

Washington County Or Property Tax Calculator Smartasset

How Much Will You Pay In Property Taxes Next Year Figure Out Your Bill With Our Calculator

Evaluation Of The Property Tax Postponement Program

The Property Tax Annual Cycle Myticor

Secured Property Taxes Treasurer Tax Collector